Surgical Robots represent a pinnacle of innovation in healthcare robotics, blending advanced engineering, artificial intelligence, and precision mechanics to enhance surgical procedures. These systems assist surgeons in performing minimally invasive operations with unprecedented accuracy, dexterity, and control, reducing patient trauma and improving outcomes.

As of December 2025, surgical robots are integral to fields like urology, gynecology, cardiothoracic surgery, and orthopedics, with over 10,000 systems installed globally and millions of procedures performed annually. This article provides a detailed exploration of their history, functionality, types, applications, advantages, challenges, market dynamics, and future trends.

History of Surgical Robots

The roots of surgical robotics trace back to the 1980s, when early prototypes emerged from military and space research. The PUMA 560 robot performed the first robotic neurosurgical biopsy in 1985, marking a milestone. NASA’s interest in telesurgery for astronauts led to collaborations that birthed systems like the da Vinci Surgical System, developed by Intuitive Surgical and first FDA-approved in 2000 for general laparoscopic surgery.

The 2000s saw rapid adoption, with da Vinci dominating the market. By the 2010s, competitors like Medtronic’s Hugo and CMR Surgical’s Versius entered, expanding accessibility. The COVID-19 pandemic accelerated remote and autonomous features. As of 2025, advancements include AI integration and expanded indications, with FDA clearances for new systems like CMR’s Versius for broader abdominal procedures.

How Surgical Robots Work: The Science Behind Them

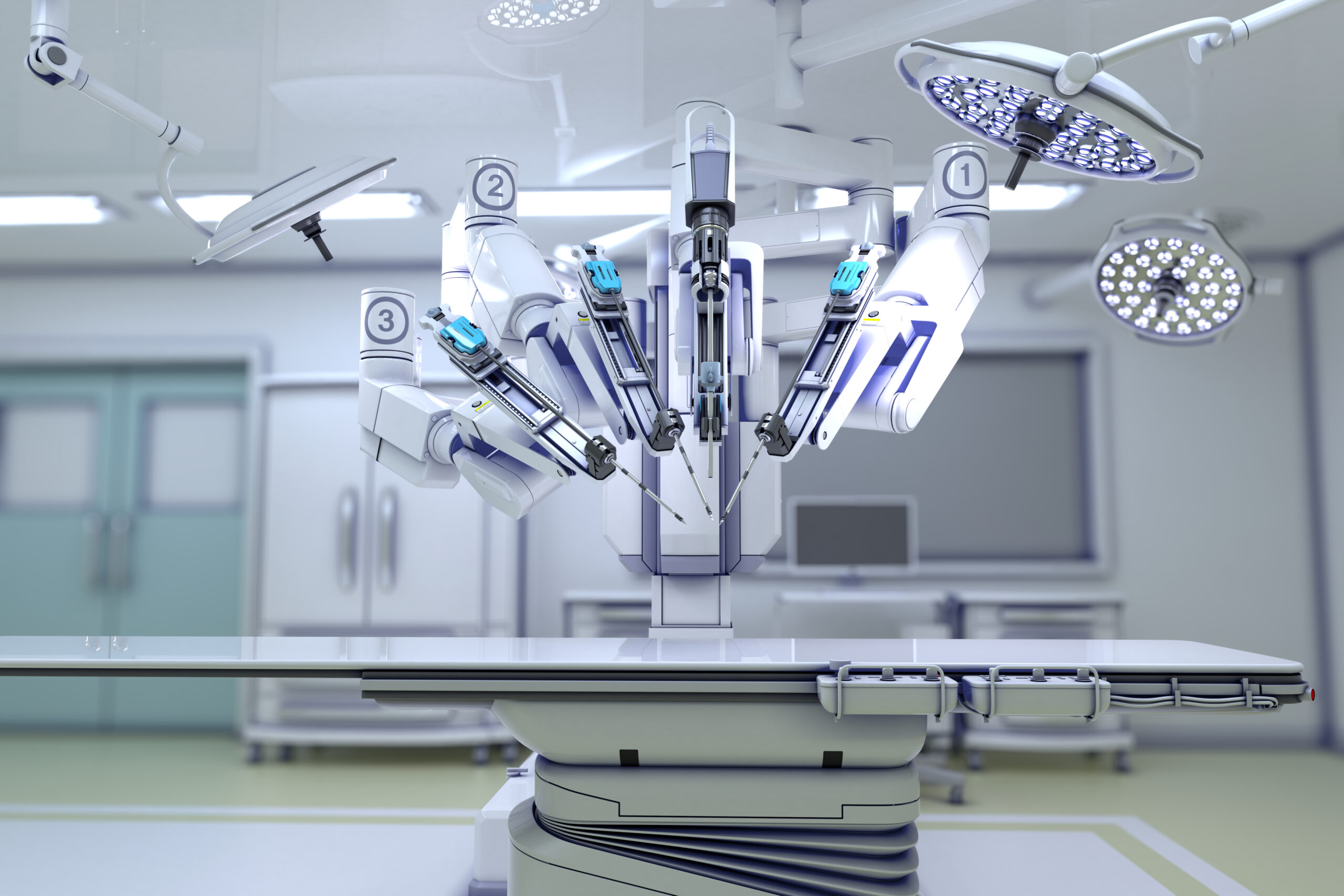

Surgical robots are telemanipulators where surgeons control robotic arms via a console, often with haptic feedback, 3D visualization, and tremor filtration. Key components include:

- Master Console: Surgeon’s interface with joysticks, foot pedals, and high-definition screens for immersive control.

- Patient-Side Cart: Houses robotic arms (typically 3–4) with interchangeable instruments like scalpels, graspers, or cameras.

- Vision System: Provides magnified 3D-HD views, often with fluorescence imaging for tissue differentiation.

- Endowrist Instruments: Mimic human wrist motion with 7 degrees of freedom, enabling precise maneuvers in tight spaces.

The process involves small incisions for arm insertion, reducing blood loss and infection risk. AI enhancements in 2025 models analyze real-time data for predictive guidance, such as collision avoidance or optimal suture paths.

Types of Surgical Robots

Surgical robots vary by design and application:

- Teleoperated Systems: Surgeon-controlled, like Intuitive’s da Vinci (multi-port) and da Vinci SP (single-port for natural orifice access).

- Autonomous or Semi-Autonomous: Emerging, with AI handling repetitive tasks (e.g., suturing). Examples include Mazor X Stealth for spine surgery.

- Miniaturized/Micro-Robots: For endovascular or ophthalmic procedures, like Monarch Platform for bronchoscopy.

- Collaborative Robots (Cobots): Assist in orthopedics, like Stryker’s Mako for joint replacements, providing haptic boundaries.

Other classifications include soft robotics for delicate tissues and swarm robotics for exploratory concepts.

Applications in Healthcare

Surgical robots excel in minimally invasive surgery (MIS), transforming specialties:

- Urology: Prostatectomies with da Vinci, reducing incontinence and impotence risks.

- Gynecology: Hysterectomies and myomectomies, with shorter recovery.

- Cardiothoracic: Mitral valve repairs and lung resections.

- Orthopedics: Knee/hip replacements with robotic planning for precise alignment.

- General Surgery: Hernia repairs, bariatrics, and colorectal procedures.

In 2025, applications extend to telesurgery for remote areas and training via simulation.

Advantages and Disadvantages

Advantages:

- Precision and Dexterity: Tremor elimination and scaled motion enable sub-millimeter accuracy.

- Minimally Invasive: Smaller incisions lead to less pain, blood loss, and hospital stays (e.g., 25% shorter operative time with AI-assisted systems).

- Improved Outcomes: Up to 30% fewer complications; better ergonomics reduce surgeon fatigue.

- Training and Accessibility: Simulators enhance skills; remote capabilities address shortages.

Disadvantages:

- High Costs: Systems exceed $1–2 million, plus maintenance and disposables, limiting adoption in low-resource settings.

- Learning Curve: Surgeons require extensive training (100+ cases for proficiency).

- Technical Limitations: Lack of full haptic feedback in some models; dependency on technology (e.g., system failures).

- Ethical Concerns: Over-reliance on robots; equity issues in access.

Market Overview

The surgical robots market reached approximately USD 11–13 billion in 2025, up from $9–11 billion in 2024, with projections to $23–30 billion by 2030 at CAGRs of 14–17%. North America holds ~40% share, driven by high adoption and R&D. Key players include Intuitive Surgical (da Vinci, market leader with 80%+ share in general surgery), Medtronic (Hugo RAS), Stryker (Mako), Zimmer Biomet (ROSA), CMR Surgical (Versius), and emerging firms like Asensus Surgical (Senhance). Growth factors: Aging populations, rising chronic diseases, and regulatory approvals (e.g., Intuitive’s da Vinci 5 in 2024).

Latest Advancements in 2025

2025 saw significant strides:

- AI Integration: Systems like da Vinci 5 use ML for real-time analytics, reducing errors.

- New Clearances: CMR Surgical’s Versius gained FDA nod for urology; Intuitive expanded SP indications to thoracic.

- Miniaturization: Single-port and flexible robots like Versius enable scarless surgery.

- Sustainability: Eco-friendly designs with reusable instruments.

- Telemedicine Fusion: Enhanced remote mentoring during procedures.

Future Trends

By 2030, expect:

- Autonomy Levels: From assisted to supervised autonomy, with AI handling 20–30% of tasks.

- Affordability: Modular, lower-cost systems for emerging markets.

- Multi-Modal Imaging: AR/VR overlays for enhanced visualization.

- Broader Adoption: In pediatrics, neurosurgery, and global health initiatives.

- Regulatory Evolution: Faster approvals for AI-enabled devices.

In conclusion, surgical robots are revolutionizing healthcare robotics, offering transformative benefits while addressing challenges through innovation. As technology matures, they promise more equitable, efficient surgery worldwide.

More articles by ZMR Researche:

https://www.zionmarketresearch.com/de/report/molded-underfill-material-market-size

https://www.zionmarketresearch.com/de/report/electrical-engineering-services-market-size

https://www.zionmarketresearch.com/de/report/sbq-special-bar-quality-steel-market

https://www.zionmarketresearch.com/de/report/hsc-milling-machines-market

https://www.zionmarketresearch.com/de/report/flip-chip-bonder-market