Targeted Sequencing and Resequencing represent a cornerstone of modern genomics, enabling researchers and clinicians to focus on specific genomic regions of interest rather than sequencing the entire genome. Targeted sequencing involves enriching and sequencing predefined genes or regions, while resequencing typically refers to the repeated or deeper sequencing of those targets for validation, variant detection, or follow-up analysis. These approaches leverage next-generation sequencing (NGS) technologies to provide high-depth coverage at a fraction of the cost and data burden of whole-genome sequencing (WGS).

As of December 2025, the global targeted sequencing and resequencing market is valued at approximately USD 9-10 billion, with projections to reach USD 27-70 billion by 2030-2034, driven by CAGRs of 20-23%. This explosive growth stems from applications in precision oncology, rare disease diagnostics, infectious disease monitoring, and pharmacogenomics, fueled by declining costs, improved panels, and regulatory support for companion diagnostics.

Definitions and Key Concepts

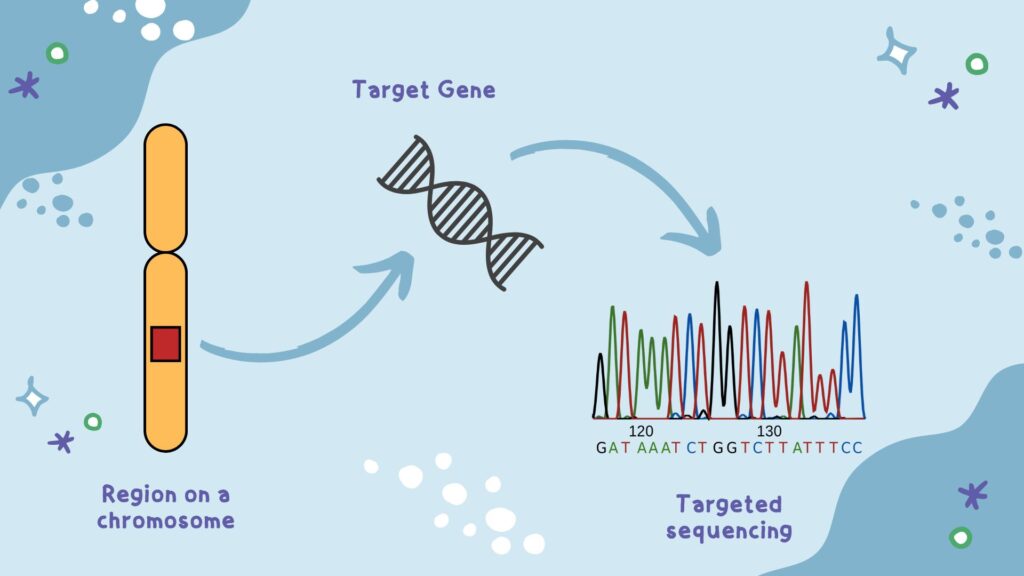

Targeted Sequencing: A method that selectively captures and sequences specific genomic regions (e.g., exons, gene panels, or hotspots) using enrichment techniques. It contrasts with broader methods like WGS or whole-exome sequencing (WES).

Resequencing: Often used interchangeably with targeted sequencing in clinical contexts, it involves sequencing known regions again for higher accuracy, variant confirmation, or longitudinal monitoring (e.g., tumor evolution).

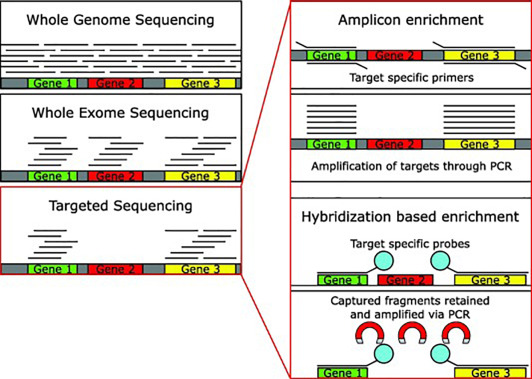

Compared to WGS (entire ~3 billion bases) or WES (~1-2% of genome, focusing on exons), targeted approaches cover <0.1-1% but achieve 100-1000x deeper coverage, ideal for detecting low-frequency variants like somatic mutations in cancer.

Methods of Target Enrichment

Two primary techniques dominate:

- Amplicon-Based (PCR Enrichment): Uses multiplex PCR to amplify targets. Fast, cost-effective for small panels, but prone to bias and limited scalability.

-

Hybrid Capture: Employs biotinylated probes to hybridize and pull down targets. More uniform coverage, handles larger panels (thousands of genes), and better for FFPE samples.

Workflow: Library prep → Enrichment → Sequencing → Alignment/Variant Calling.

Advantages Over Broader Sequencing

- Cost-Effectiveness: 10-50x cheaper than WGS for equivalent depth.

- Higher Sensitivity: Deeper coverage detects rare variants (e.g., <1% allele frequency in tumors).

- Faster Turnaround: Less data (GB vs. TB) simplifies analysis.

- Clinical Focus: Reduces incidental findings and variants of uncertain significance (VUS).

- Scalability: Custom panels for specific diseases.

Drawbacks: Misses novel variants outside targets; requires prior knowledge of regions.

Applications in 2025

Oncology: Dominant use; panels profile tumors for actionable mutations (e.g., EGFR, KRAS), guiding targeted therapies and monitoring resistance.

Inherited Diseases: Panels for cardiomyopathy, neurology, or rare disorders.

Infectious Diseases: Pathogen identification, resistance profiling.

Pharmacogenomics: Drug response prediction.

Non-Invasive Prenatal Testing (NIPT): Targeted cfDNA analysis.

Market Dynamics and Trends

North America leads (~50% share), driven by FDA approvals and oncology demand. Key players: Illumina, Thermo Fisher, Roche, Agilent, QIAGEN.

| Year | Market Size (USD Billion) | CAGR (%) | Key Notes |

|---|---|---|---|

| 2024 | 7.4-8.7 | – | Post-WGS maturation |

| 2025 | 9.8-10.7 | 20-23 | AI integration, larger panels |

| 2030 | 22.8-69.2 | 20-23 | Precision medicine expansion |

Trends: AI-driven variant interpretation; liquid biopsy panels; multi-omics integration; cost reductions enabling broader adoption.

Challenges

- Panel design bias.

- Standardization across labs.

- Reimbursement variability.

- Data privacy in clinical use.

Future Outlook

By 2030, expect ultra-large panels (>10,000 genes), CRISPR-based enrichment, and routine integration with long-read sequencing for structural variants. Targeted approaches will remain pivotal in clinical genomics, balancing depth and breadth.

Conclusion

Targeted sequencing and resequencing have democratized high-resolution genomics, powering precision medicine in 2025. As costs fall and panels evolve, they bridge discovery (WGS) and diagnostics, transforming patient care—especially in oncology. For researchers and clinicians, these tools offer unparalleled focus in an era of genomic abundance.

More articles by Zion Researche:

https://www.zionmarketresearch.com/de/report/femoral-canal-brush-market

https://www.zionmarketresearch.com/de/report/idi-contact-technology-market

https://www.zionmarketresearch.com/de/report/oil-mist-separator-market

https://www.zionmarketresearch.com/de/report/cross-traffic-alert-market

https://www.zionmarketresearch.com/de/report/interconnect-data-center-solution-market